BLOG

Profitable Strategies: Lead Generation for Insurance Agents (2026-ready)

Lead generation for insurance agents is hard. Budgets are tight. Markets are noisy. So instead of chasing every new lead, the smartest agencies squeeze more value from what they already have while targeting the right new prospects. Below is a compact, actionable playbook you can use this week to generate higher-quality leads and grow revenue faster.

Quick TL;DR

Start with your current book: upsell and cross-sell.

Pick 1 niche and build a dedicated landing page and content stream for it.

Automate follow-up and scoring so no lead falls through the cracks.

Use small-budget tests for paid or direct mail, then scale what converts.

Route hot leads to sales within your SLA and measure CPL, conversion rate, and LTV.

1. Upsell and cross-sell your existing clients — fastest path to profit

Why this works

Lower acquisition cost, higher trust, faster close.

Expanding wallet share is often cheaper and more predictable than hunting net new.

How to do it

Segment clients by products and life or business events.

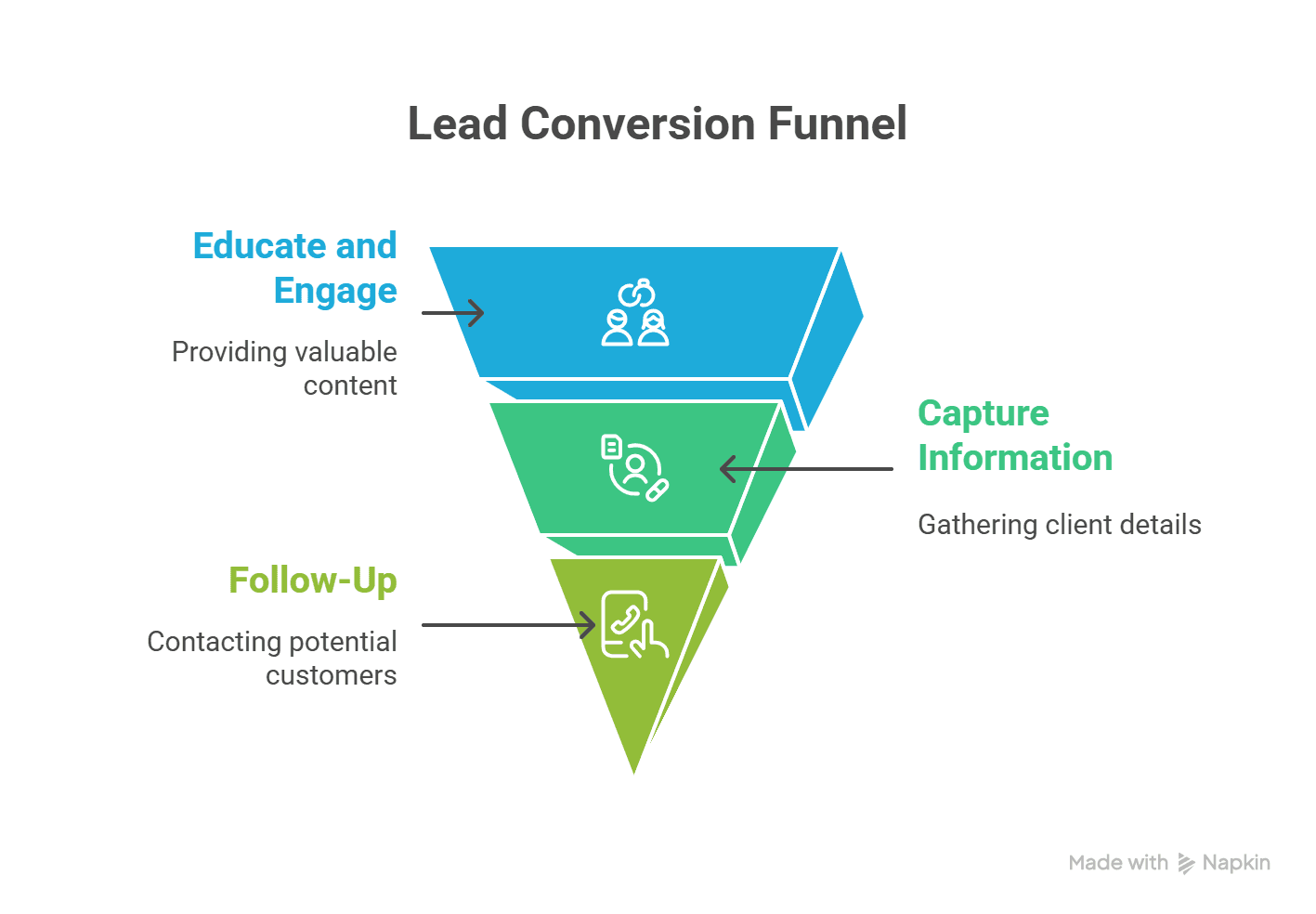

Create email and SMS sequences that educate and add value, then invite them to update their risk profile.

Send prospects to a short form asking what coverage they need, phone, and email. Capture responses and show a Thank You page that explains next steps.

Route submissions to your sales queue for immediate follow-up.

Examples

Add workers comp to a commercial GL client.

Offer umbrella or life to personal lines clients with increasing assets.

Pro tip

Use client data to trigger personalized outreach. Even simple automation increases cross-sell conversion significantly.

2. Target niche businesses — become the obvious choice

Why niche

Targeting a specific industry makes your messaging sharper and your credibility higher. Clients prefer specialists.

How to execute

Pick a niche in your territory: coffee shops, pizzerias, car washes, small manufacturers.

Build a landing page for that niche that explains common exposures and solutions.

Publish regular micro-content for that page: short blog posts, checklist, and a case example.

Add a lead-capture form at the bottom of each post.

Content ideas

“Top 5 insurance gaps coffee shops miss”

“Checklist: Is your car wash protected for equipment failure?”

Use AI to speed it up

Generate first-draft content with AI, then edit to add local examples and real client outcomes. AI saves time, but human edits keep credibility high.

3. Automated nurture and strict follow-up — stop losing leads

Problems this fixes

Leads collected but never contacted.

Marketing activity that doesn’t convert because sales is slow.

System

All leads enter CRM with a source tag.

Score leads automatically: behavior + profile + intent.

Hot leads get routed to sales with a 15-minute response SLA.

Warm leads go into a tailored drip sequence referencing the niche or product they showed interest in.

Follow-up checklist

Immediate automated confirmation.

Sales call within SLA for hot leads.

3-touch human follow-up if no response in 72 hours.

4. Use micro-experiences to build trust

What it means

Micro-experiences are focused interactions that make it easy for prospects to say yes.

Examples

Risk profile form with a single next action.

Short video that previews what an onboarding call looks like.

One-page comparison that explains why your agency protects coffee shops better than a generalist.

Why it works

Short, relevant experiences reduce friction and increase conversions.

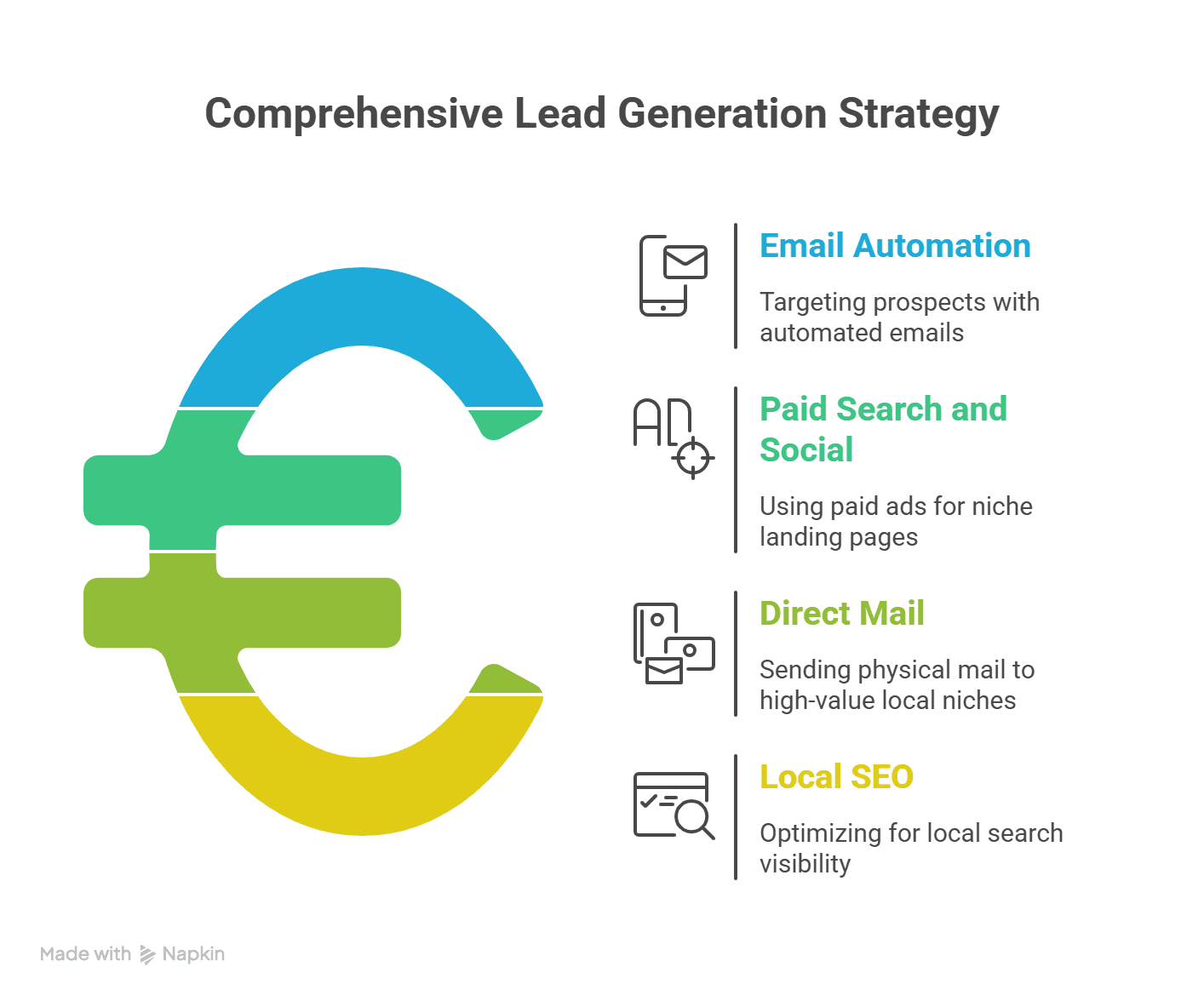

5. Mix channels for maximum reach

Channels to test

Email automation targeting your book and prospects.

Paid search and geo-targeted social for niche landing pages.

Direct mail for high-value local niches.

Local SEO for niche + city pages.

Budget approach

Start small, measure CPA and conversion, then scale winners. Direct mail can outperform digital in niche local markets if the offer is clear.

6. Build credibility: reviews, content, and case snippets

Credibility moves prospects from curiosity to contact.

Practical steps

Add 3 client testimonials to each niche landing page.

Publish one short case study showing real results.

Highlight Google reviews on the landing page and in nurture emails.

7. Measurement and pipeline hygiene

Track these KPIs every week

Leads by source and niche.

Cost per lead.

Lead-to-appointment rate.

Appointment-to-policy conversion.

Time from lead to first sales contact.

Pipeline hygiene

Remove stale contacts, dedupe records, and update decision-maker data monthly.

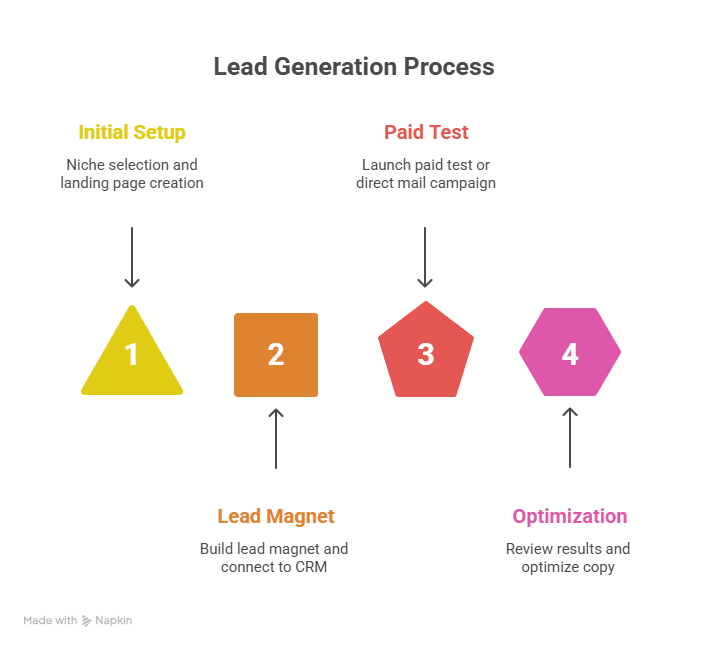

8. Small launches you can do this month

Week 1

Pick a niche, create a landing page, and write 1 blog post.

Week 2Build a short lead magnet or checklist and connect the form to CRM.

Week 3Launch a 2-week paid test at low budget or send 250 targeted direct mail pieces.

Week 4Review results, optimize copy, and scale the winning channel.

Final notes on tools and people

You do not need expensive tools to start. A basic CRM, an email automation tool, and a simple landing page builder are enough to run the playbook above. Add phone routing and a dialer as you scale.

Want a hands-on shortcut that actually converts?

GrowthBeam helps insurance agencies turn these exact tactics into booked appointments and closed policies without the guesswork. We combine verified contact data, niche landing page playbooks, automated outreach, and tight CRM routing so your team answers the right leads at the right time. If you want, GrowthBeam can run a short pilot focused on one niche, deliver qualified meetings, and hand you the repeatable playbook to scale.