BLOG

Lead Generation for Insurance Agencies — The 2026 Playbook

Whether you sell life, auto, health, or commercial insurance, consistent lead flow is the engine of growth. This 2026 playbook turns that engine into a reliable machine. It combines strategy, data, automation, and human follow-up so your agency converts more prospects into long-term policyholders.

Below is a concise, actionable guide that covers what lead generation means for insurance, why it matters, the full process, and the tactics that actually produce high-quality leads.

TL;DR — What to do first

Define 2 priority buyer personas and map their journey.

Build 2 product-specific landing pages with lead magnets.

Connect all acquisition sources into a single CRM.

Score leads and set an SLA for sales follow up.

Launch a 30-day nurture email sequence and one paid channel.

Measure CPL, conversion rate, LTV, and CAC weekly.

1. What is lead generation for insurance agencies?

Lead generation is the process of finding, attracting, and qualifying potential customers who are likely to buy insurance. For agencies, it means moving prospects from awareness to quote to policy via digital and offline touchpoints.

Why it is critical:

Insurance is competitive and trust-driven.

Buyers research heavily online before talking to an agent.

A steady pipeline reduces revenue volatility and improves scale.

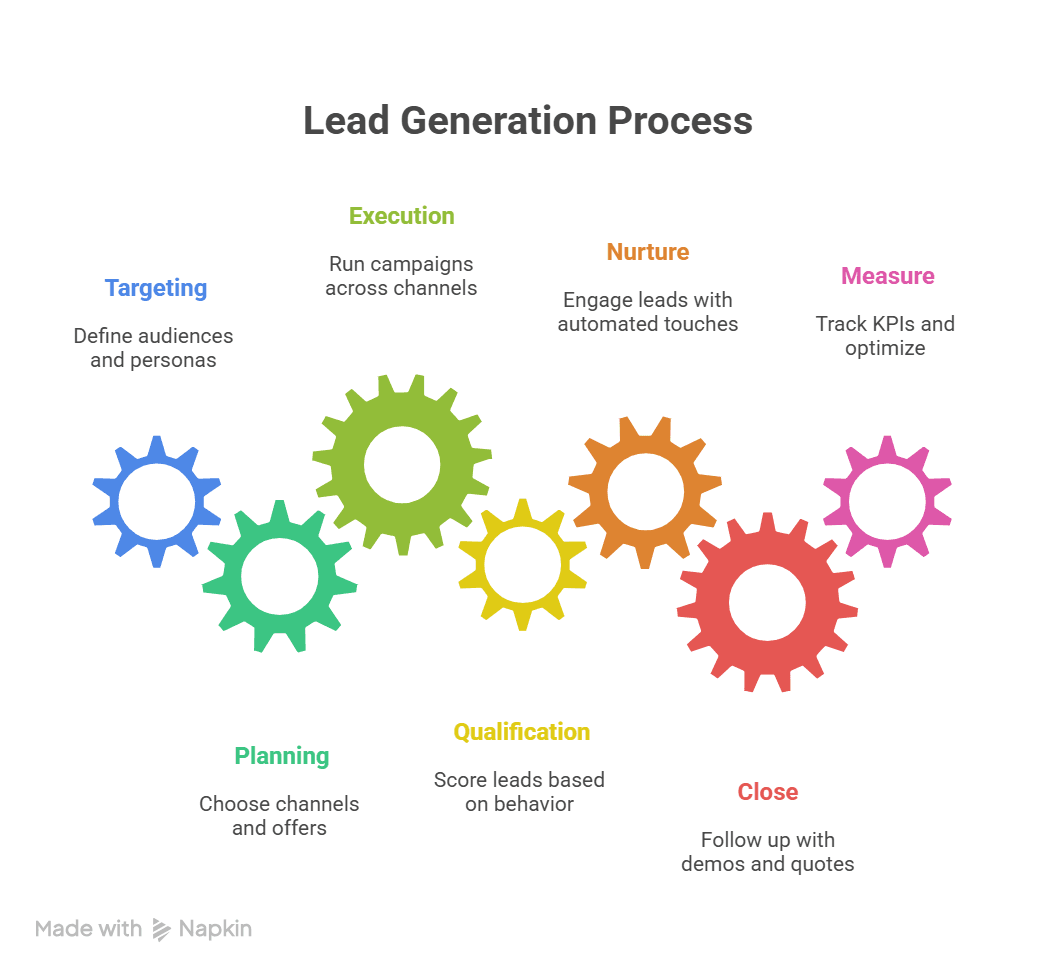

2. The end-to-end lead generation process

Targeting — define audiences and personas.

Planning — choose channels and offers mapped to buyer stages.

Execution — run campaigns: SEO, content, social, paid, partners.

Qualification — score leads using behavior and firmographics.

Nurture — automated email, retargeting, content touches.

Close — fast human follow-up, demos, quotes.

Measure — track KPIs and optimize.

3. Target audience and buyer personas

Create realistic personas with:

Demographics: age, income, location.

Psychographics: risk tolerance, online behavior.

Decision criteria: price, speed, support, flexibility.

Preferred channels: search, social, email, phone.

Example personas:

Young professional buying first life insurance — values simplicity and price.

Small business owner buying commercial liability — values customization and fast quotes.

Homeowner seeking multi-policy discount — values trust and claims service.

Map messaging, landing pages, and lead magnets to each persona.

4. Data is everything — quantitative and qualitative

Use both:

Quantitative data:

Traffic, CTR, bounce, conversion rate, CPL.

Channel performance and time-to-conversion.

Qualitative data:

Win/loss interviews, chat transcripts, survey feedback.

Why did a prospect pick another insurer?

Combine them to refine targeting, creative, and pricing.

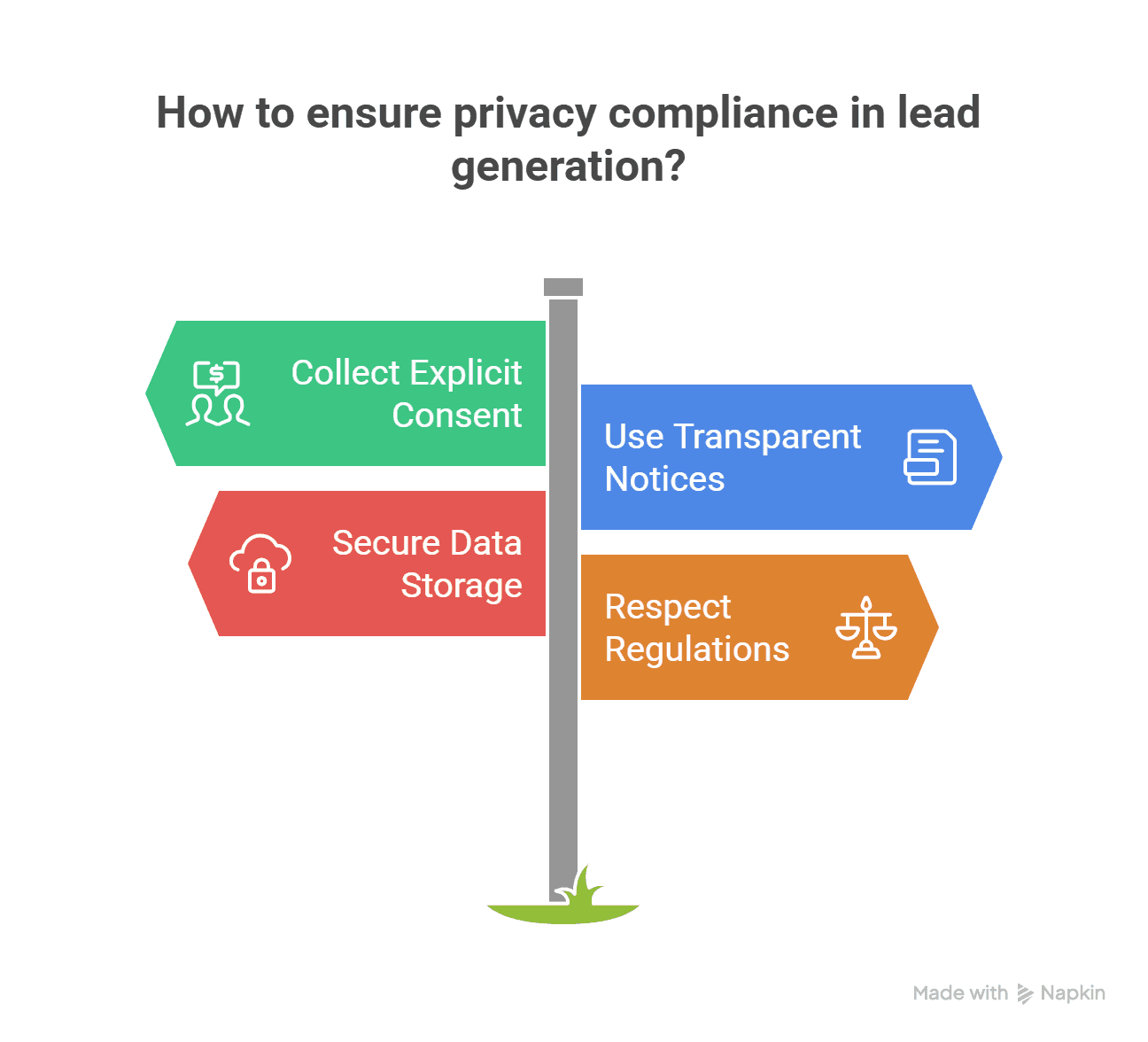

5. Privacy and compliance

Follow privacy laws and best practices:

Collect explicit consent for marketing.

Use transparent privacy notices and cookie banners.

Store data securely and audit access.

Respect local insurance and advertising regulations.

Non-compliance costs money and trust.

6. CRM is indispensable

A modern CRM centralizes leads and activity, and it must:

Capture leads from all channels automatically.

Record interactions: emails, calls, chat transcripts.

Run lead scoring and routing workflows.

Provide dashboards for CAC, CPL, conversion, and LTV.

Set an SLA: first response within 15 minutes for hot leads.

7. Use AI smartly

AI helps at scale:

Predictive lead scoring to prioritize high-value prospects.

Personalize email subject lines and landing page copy.

Auto-enrich lead data and detect intent signals.

Chatbots for qualification with human handoff.

AI speeds decisions; humans close deals.

8. Content and SEO — the long-term backbone

Content types that convert:

Buyer guides and FAQs.

Comparison pages and calculators.

Case studies and customer stories.

Video explainers for complex policies.

SEO best practices:

Target high-intent keywords per product.

Build local pages for geo-targeting.

Use schema for FAQs and reviews.

Publish regularly and earn backlinks.

Organic traffic compounds over time and lowers CPL.

9. Social media and paid channels

Match channel to persona:

LinkedIn for commercial insurance and partnerships.

Facebook and Instagram for consumer lines.

Google Search for high-intent queries.

Ad tips:

Send paid traffic to product-specific landing pages.

Use retargeting and lookalike audiences.

Measure channel ROI per campaign, not just impressions.

10. Lead magnets that work

High-converting lead magnets:

Quote calculators and comparison tools.

“What cover do I need?” checklists.

E-books: “How to lower small business insurance costs.”

Free consultation scheduling.

Keep forms short. Use progressive profiling to collect more details later.

11. Lead scoring and routing

Score based on:

Demographics: income, company size.

Behavior: pages visited, forms submitted, email opens.

Intent: quote requests, comparison tool use.

Route:

Hot leads to sales for immediate follow-up.

Warm leads to nurture flows.

Low intent to long-term content drip.

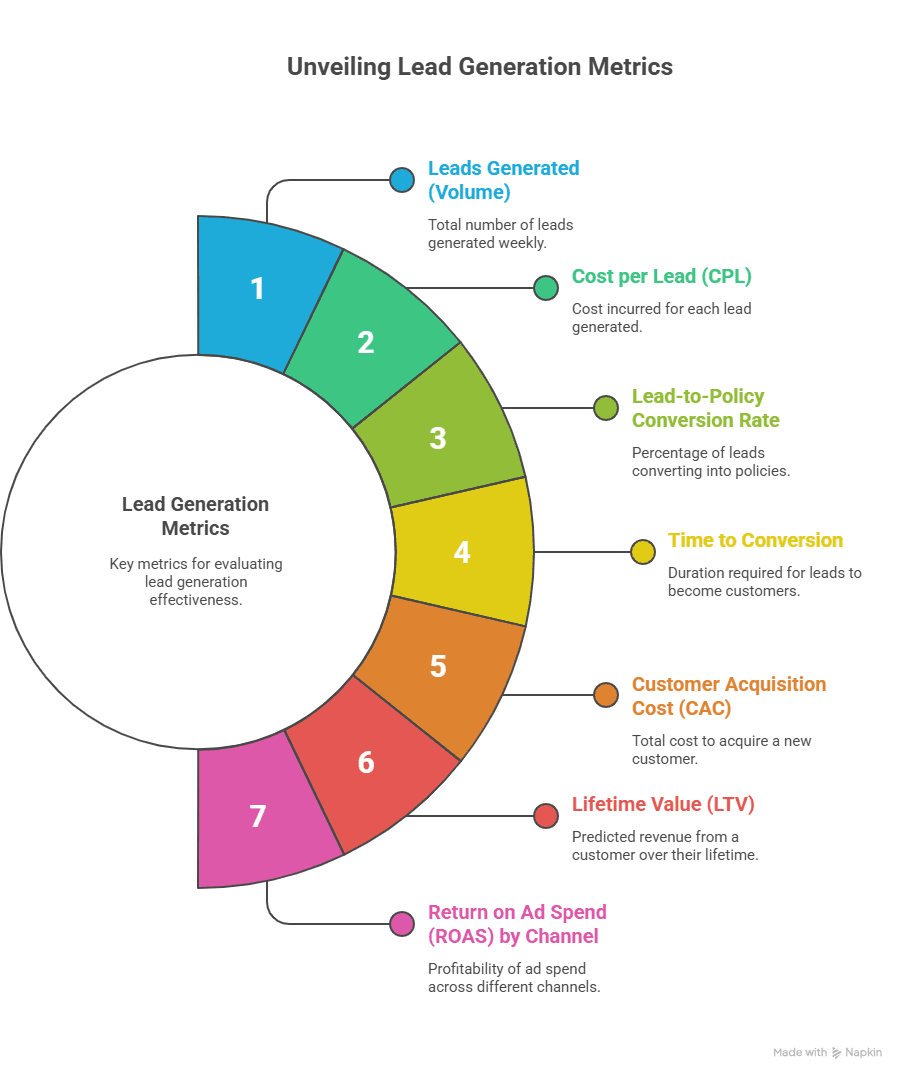

12. KPIs you must track

Track weekly and optimize:

Leads generated (volume)

Cost per Lead (CPL)

Lead-to-policy conversion rate

Time to conversion

Customer Acquisition Cost (CAC)

Lifetime Value (LTV)

Return on Ad Spend (ROAS) by channel

Use these to kill losing experiments and scale winners.

13. Common mistakes to avoid

Targeting everyone instead of specific personas.

Running PPC without product landing pages.

Siloed marketing and sales teams.

Not tracking consent and data usage.

Ignoring qualitative feedback from prospects.

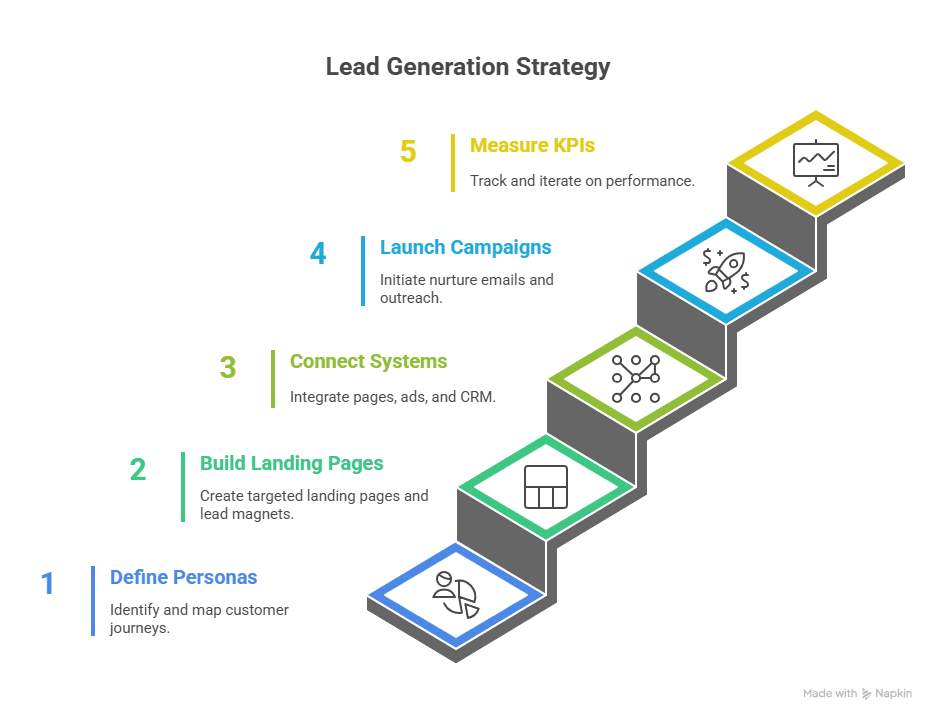

14. Simple 30-day action plan

Week 1: Define 2 personas and map their journeys.

Week 2: Build 2 landing pages and a lead magnet per persona.

Week 3: Connect pages, ads, chat, and email to your CRM. Set scoring rules.

Week 4: Launch nurture emails, one paid channel, and a small partnership outreach.

Ongoing: Measure KPIs weekly, iterate every 14 days.

15. Final checklist before you scale

Personas documented and approved.

Landing pages live and mobile-optimised.

CRM integration and lead routing set.

Lead scoring and SLA established.

One test campaign running with tracked KPIs.

Want to move faster?

If you want a ready-made playbook and a hands-on pilot, GrowthBeam helps insurance agencies by combining verified data, automated outreach, and CRM routing so your team responds faster and closes more. We run a short pilot, deliver qualified leads, and hand over a playbook you can scale.