BLOG

Insurance Lead Generation: The 2026 Basics

Where insurance agents should start, what actually works, and why AI-powered platforms like GrowthBeam now outperform every traditional lead source.

Insurance agents need one thing to grow consistently: a predictable flow of quality leads. But relying only on referrals or walk-ins stalls growth, and inconsistent prospecting keeps agencies stuck at the same revenue ceiling year after year.

This 2026 guide breaks down the foundations of insurance lead generation, the best places to find new prospects, and how to convert them into paying policyholders. Most importantly, it shows why modern agencies are shifting toward AI-powered outbound platforms like GrowthBeam to generate their own exclusive, high-intent insurance leads at scale.

What exactly is insurance lead generation?

Insurance lead generation is the process of identifying, contacting, and converting potential customers interested in policies like auto, home, life, commercial, or specialty insurance. Without it, your agency growth is capped. With a predictable pipeline, your revenue compounds every month.

In 2026, lead generation is no longer just buying lists or waiting for inbound calls. It’s about:

Reaching the right prospects before competitors

Personalizing your outreach across multiple channels

Responding instantly and consistently

Using data and automation to convert more conversations into sales

This is where GrowthBeam’s AI-driven outbound engine shines.

5 Ways Insurance Agents Can Generate More Leads (2026 Edition)

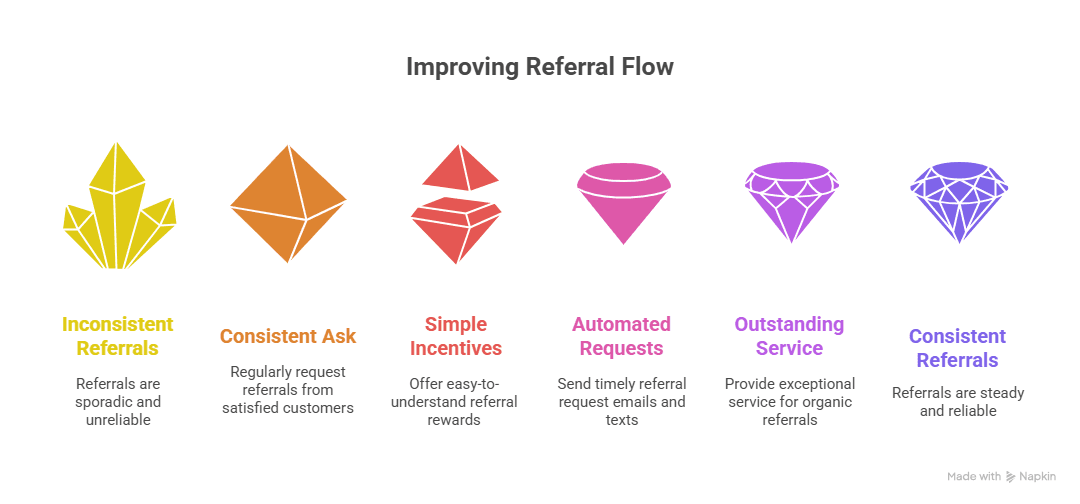

1. Customer referrals

Still one of the strongest lead sources. When a customer has a great experience, they naturally refer friends and family.

Tips to improve referral flow:

Ask consistently at renewal or after a positive interaction

Offer simple, low-pressure incentives

Send automated “referral request” emails and texts

Deliver outstanding service so referrals happen organically

How GrowthBeam helps:

GrowthBeam automatically identifies satisfied customers, triggers referral messages, and nurtures warm introductions—no manual work needed.

2. Community outreach

Local presence still matters, especially for lines like home, auto, business, and life.

Great outreach tactics include:

Chamber of Commerce networking

Partnerships with auto dealerships and mortgage lenders

Leaving cards or QR codes in high-traffic locations

Hosting small educational sessions

It’s manual, but it builds lasting relationships and trust.

3. Traditional advertising

While less targeted, channels like:

Mailers

Local newspaper ads

Out-of-home boards

Flyers

still help build recognition in smaller or referral-heavy markets.

However, cost-per-lead is often high, and tracking ROI can be difficult.

4. Digital marketing

Where modern agencies win. Insurance shoppers search online first—so digital channels are essential:

Digital lead gen includes:

Search ads

Facebook and Instagram campaigns

LinkedIn outreach (especially commercial lines)

Email marketing to past prospects

Retargeting ads to recapture website visitors

GrowthBeam advantage:

GrowthBeam automates and personalizes outbound email and multichannel outreach using AI, letting agents scale digital prospecting without needing full marketing teams.

5. Online insurance leads

These are prospects who fill out quote forms on comparison sites. They share their details, risk profile, and intent—which can make them strong leads if they’re fresh and accurate.

However, quality varies wildly:

Some vendors resell the same lead to 5–10 agents

Some sell aged leads (15–90 days old)

Some provide inaccurate or incomplete submissions

Competition is high

You must choose the right source and act fast.

How to Find and Convert High-Intent Online Insurance Leads

1. Choose the right lead provider

Not all lead vendors are equal. Ask:

How many agents receive the same lead?

How fast is the lead delivered after submission?

Can you filter by location, age, risk, or policy type?

Are leads exclusive or shared?

What’s the refund policy for bad data?

But here’s the shift in 2026:

Top agents aren’t buying leads anymore—they’re generating their own exclusive leads with AI-driven outbound platforms like GrowthBeam, which provides:

Verified decision-maker emails

Personalized outbound sequences

AI-written messaging tuned for each policy line

Automatic follow-up with perfect timing

Zero competition (exclusive leads only)

You control quality, targeting, and cost.

2. Speed is everything

Whether you buy leads or generate them, speed-to-contact determines conversion.

Agents who call within 5 minutes see conversion rates 3–7x higher than those who wait an hour.

Best practices:

Call instantly

Use SMS as backup

Follow up consistently for 7–12 attempts

Keep outreach friendly and conversational

GrowthBeam helps you contact leads instantly, using automated email + AI-personalized messaging sequences that nurture until the prospect replies.

3. Meet shoppers where they are

Modern consumers expect flexibility. Some prefer calls, others text, others email or live chat. Your response channels should include:

Phone

SMS

Email

Website chat

After-hours automation

This omnichannel presence dramatically increases contact rates.

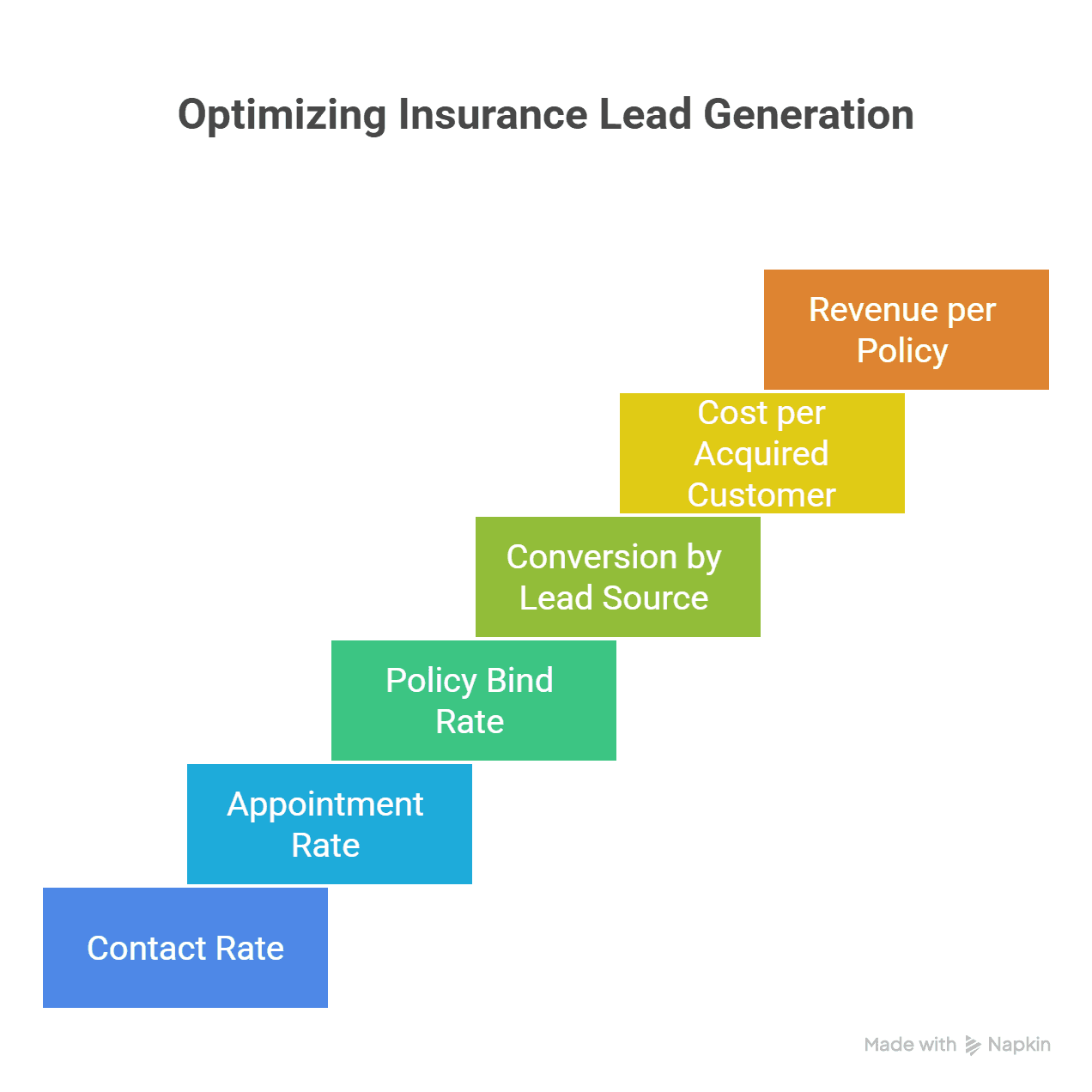

4. Measure everything

To optimize insurance lead generation, track:

Contact rate

Appointment rate

Policy bind rate

Conversion by lead source

Cost per acquired customer

Revenue per policy by segment

Use this data to refine your strategy—double down on what works and drop what doesn’t.

GrowthBeam provides full analytics, showing lead source performance, open and reply rates, and projected revenue—so you always know your ROI.

The Smarter Way to Generate Insurance Leads in 2026

Traditional lead buying is unpredictable, expensive, and competitive. Agencies that thrive in 2026 are shifting to AI-powered, outbound-first lead generation, where they control:

The audience

The message

The timing

The volume

The cost

And GrowthBeam makes this turnkey.

Why Top Insurance Agencies Now Prefer GrowthBeam

Instead of buying shared, outdated leads, GrowthBeam helps insurance agents:

Build targeted prospect lists instantly

Launch personalized email outreach with AI

Automate follow-up across multiple channels

Generate exclusive, high-intent conversations

Scale lead volume without increasing workload

Convert more prospects with less effort

It’s like having a full marketing and SDR team—without the overhead.

Want to see how GrowthBeam can generate exclusive insurance leads for you?

If you want a predictable flow of high-quality insurance leads with automated outreach and zero competition, GrowthBeam is the #1 platform to start with.

Just tell me this:

Which insurance lines do you want more leads for?