BLOG

Insurance Lead Generation Best Practices (Do’s & Don’ts) — 2026 Playbook

Acquiring high-quality insurance leads is harder and more valuable than ever. The industry spends heavily on digital marketing, but spend alone doesn’t guarantee results. The winners in 2026 blend strategy, tech, and disciplined execution: omnichannel experiences, tight measurement, and a CRM-first approach.

Below is a practical, action-oriented guide of Do’s and Don’ts that insurance marketing and sales teams can implement this quarter to increase lead quality, lower acquisition costs, and improve conversion velocity.

Quick top-level takeaways

Do build an omnichannel, measurable funnel that connects ads, email, chat, and phone.

Do centralize data in a CRM so marketing + sales speak the same language.

Don’t spray-and-pray across channels without segmentation or tracking.

Do prioritize landing pages, live chat, and email nurture to convert intent.

Don’t treat PPC as a silver bullet — it’s expensive and needs tight optimization.

The business case — why this matters in 2026

Insurers continue to allocate major budgets to digital marketing because buyers are searching online more than ever. But the buyer journey is multi-touch and often ends with a phone call or agent conversation — not a straight online purchase. That’s why the integration of digital channels with live sales workflows and CRM is the single biggest lever to improve ROI.

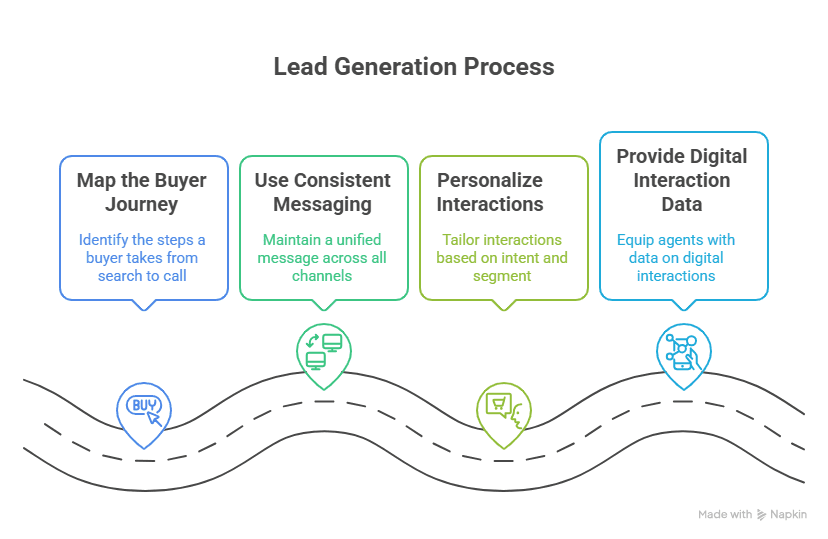

DO: Build an omnichannel journey that’s consistent and personal

Why: Buyers move across search, social, email, chat, and phone. They expect a consistent experience and quick answers.

How to do it:

Map the buyer journey (search → landing → content → chat → quote → call).

Use consistent messaging and offer across channels.

Personalize by intent, segment, and lifecycle stage.

Ensure live agents see preceding digital interactions (email opens, pages viewed, ad creative).

Example: a visitor clicks a “home insurance quote” ad, lands on a product-specific page, opens chat, and calls — the agent should already see the ad and page that brought them there.

DO: Centralize everything into a CRM (and use it)

Why: Fragmented data kills attribution, wastes spend, and creates poor customer experiences.

How to do it:

Route leads from PPC, comparison sites, email, chat, and partners into a single CRM.

Log every touch: emails, chat transcripts, call recordings, and form data.

Use CRM workflows to auto-assign, remind, and escalate hot leads.

Integrate lead scoring so sales prioritize high-intent prospects.

Outcome: Fewer missed calls, better handoffs, and reliable ROI reporting.

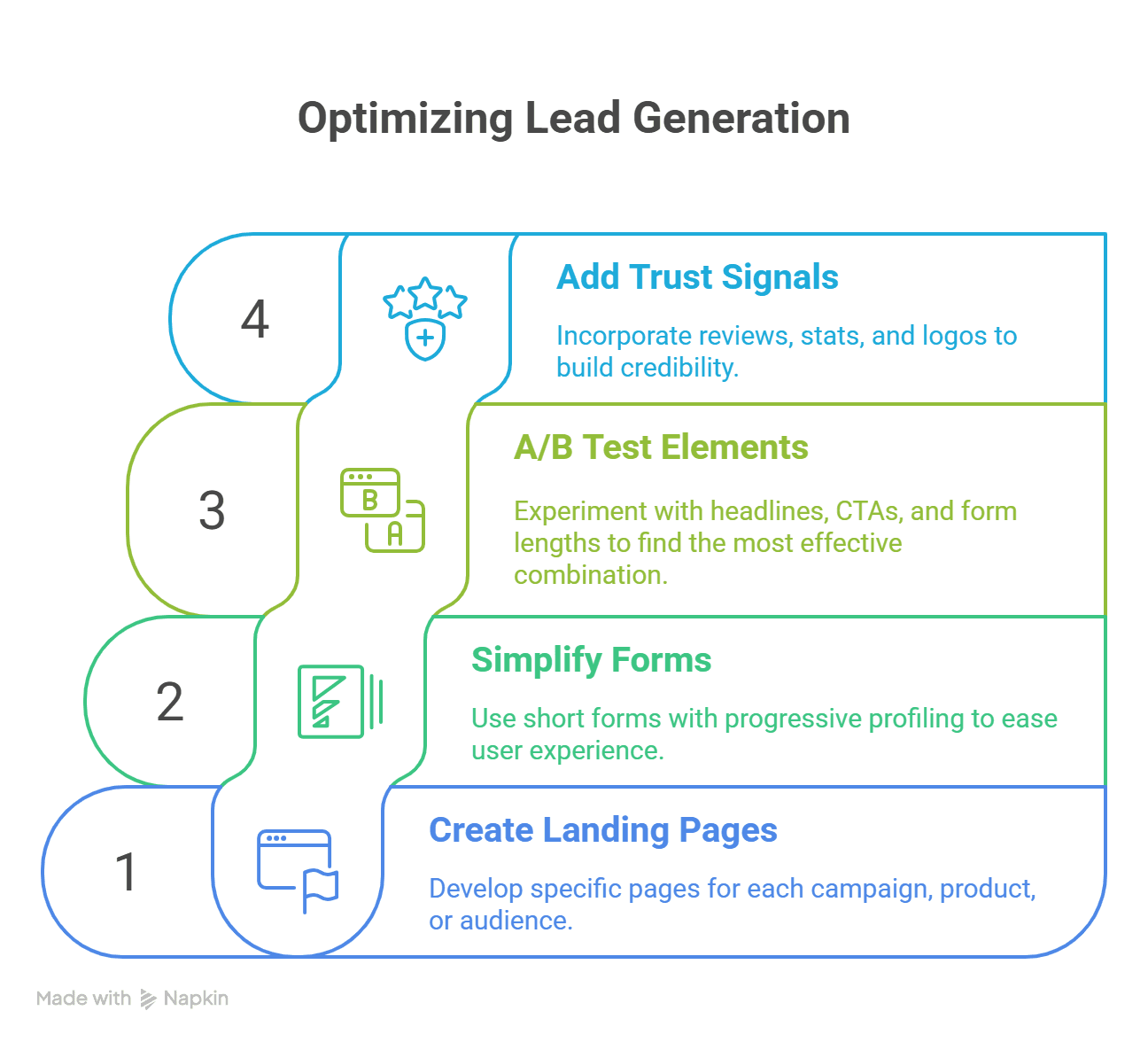

DO: Use landing pages (not just your homepage)

Why: Homepage = overview. Landing pages = conversion.

How to do it:

Create dedicated landing pages per campaign / product / audience.

Keep a single CTA and a short form (progressive profiling).

A/B test headlines, CTAs, and form length.

Add trust signals: reviews, claim-settlement stats, partner logos.

KPI: Landing page conversion rate (visitors → leads).

DO: Invest in email — it still delivers best ROI

Why: Email is cost-efficient, highly personalizable, and excellent for nurturing and cross-sell.

How to do it:

Build segmented welcome flows, quote follow-ups, and renewal sequences.

Use behavioral triggers (page visit, quote started, chat initiated).

Personalize subject lines and previews by product and intent.

Test timing and cadence — fewer, better-targeted messages win.

Metric to watch: Email-to-policy conversion and time-to-conversion.

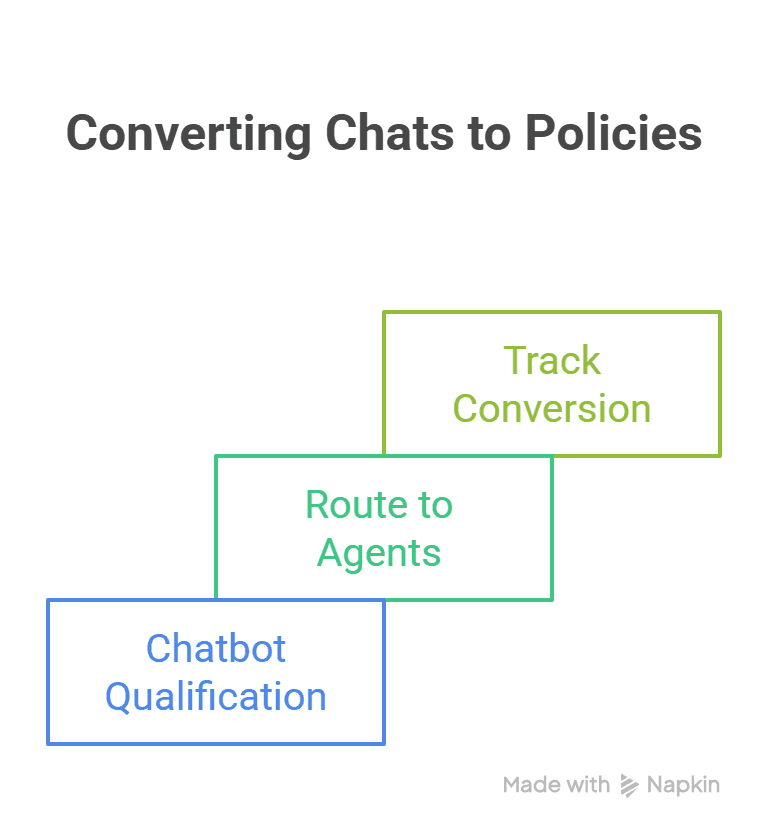

DO: Deploy chatbots + live chat — but make escalation smooth

Why: Many shoppers want quick answers or to schedule a call outside business hours.

How to do it:

Use chatbots for qualification and scheduling.

Route qualified chats to agents with context (pages viewed, ads clicked).

Track chat → call → policy conversion in CRM.

Tip: Keep bot scripts short and focused; always offer a human handoff for complex queries.

DO: Apply rigorous measurement & attribution

Why: Without measurement you’re guessing. With measurement you optimize spend and creative.

How to do it:

Track micro-conversions (CTA clicks, form starts, chat starts, phone taps).

Attribute conversions across channels (multi-touch attribution where possible).

Monitor CAC, LTV, conversion rates, and highest-performing sources.

Run controlled experiments and scale winners.

DON’T: Target everyone — segment or fail

Why: Insurance products are highly specific: family health, small business liability, renter’s insurance, etc.

What to avoid:

Generic, mass-market targeting that wastes spend.

One-size-fits-all creative and landing pages.

Do instead: Build ICPs and map offers to them — tailor messaging for life stage, industry, or vehicle type.

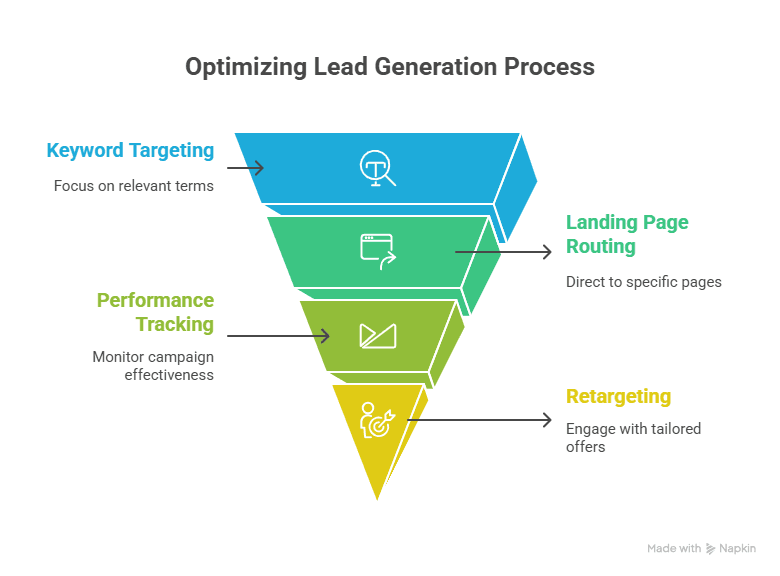

DON’T: Run PPC without a strict optimization plan

Why: Insurance CPCs are high. Uncontrolled, PPC drains budgets quickly.

How to avoid waste:

Use hyper-targeted keywords and negative keyword lists.

Route PPC traffic to product-specific landing pages (not homepage).

Track performance by campaign, ad group, and landing page.

Retarget visitors with tailored offers and urgency.

Metric: Cost per lead and cost per policy — stop bids that don’t meet thresholds.

DON’T: Ignore privacy, compliance or consent

Why: Fines and reputational risk are real. Consent is a conversion driver when done right.

Actions:

Implement consent management for email and cookies.

Ensure data use is GDPR/CCPA-aware (or local equivalent).

Be transparent about how you use prospect data.

DON’T: Let marketing and sales operate in silos

Why: Misaligned handoffs lose deals and erode customer experience.

Fix it by:

Defining SLAs for lead response time.

Sharing playbooks and call scripts based on campaign.

Using CRM dashboards visible to both teams.

Result: Faster response, better handoffs, higher close rates.

Do’s & Don’ts Cheat Sheet (TL;DR)

Do

Build omnichannel, measurable funnels.

Centralize data in CRM.

Use targeted landing pages.

Personalize email nurture.

Use chat + bot with human escalation.

Measure CAC, LTV, and conversion velocity.

Test and iterate constantly.

Don’t

Target “everyone.”

Let PPC run unchecked.

Overlook privacy and consent.

Keep marketing and sales data siloed.

Prioritize vanity metrics over revenue metrics.

Quick implementation checklist (first 30 days)

Map the buyer journey for your top 2 products.

Create 2 product-specific landing pages and one welcome email sequence.

Connect PPC, landing pages, email, and chat into your CRM.

Set lead scoring and an SLA: < 15 minutes first response.

Run one A/B test on landing page headline and one email subject line.

Why GrowthBeam helps teams execute these Do’s — without the chaos

Most insurers know what to do but struggle to do it consistently. GrowthBeam centralizes data, automates multichannel outreach, and routes leads into your CRM with full context — so your agents respond faster and your marketing dollars convert more predictably.

GrowthBeam helps you:

Combine campaign data, chat transcripts, ad performance and calls in one dashboard.

Prioritize hot leads with intent scoring.

Deploy product-specific landing pages at scale.

Automate follow-ups and SLA routing for immediate responses.

If you want a practical pilot — say the word and GrowthBeam can set up a 30-day test: landing pages, chat, email flows, and CRM routing. You’ll get measurable results and a repeatable playbook to scale.