BLOG

9 Effective Lead Generation Strategies for Insurance Companies (2026 Guide)

Insurance awareness has surged in recent years, especially after global events highlighted the importance of financial protection. Yet, despite increased awareness, many customers still hesitate, compare heavily, or require deeper education before buying a policy.

That’s where smart, scalable lead generation becomes essential.

Whether you’re an independent insurance agent or a fast-growing insurance firm, this 2026 guide gives you nine proven strategies to generate high-intent, conversion-ready insurance leads consistently.

1. Create a High-Converting Insurance Lead Generation Website

Your website is the digital face of your insurance practice. It should attract, educate, and convert visitors automatically.

What your website must include:

A clear, benefit-focused homepage

Policy-specific landing pages (auto, life, home, commercial, health)

Clean navigation and mobile responsiveness

Clear CTAs like “Get a Quote” or “Book a Free Consultation”

Instant communication options (chat, WhatsApp, callback request)

Pro-tip for 2026

Leads convert when the website feels professional, trustworthy, and easy to use. Study top-ranking competitors. Identify:

Their layout

Tone

Form placement

Value propositions

Borrow their strengths, improve on their weaknesses.

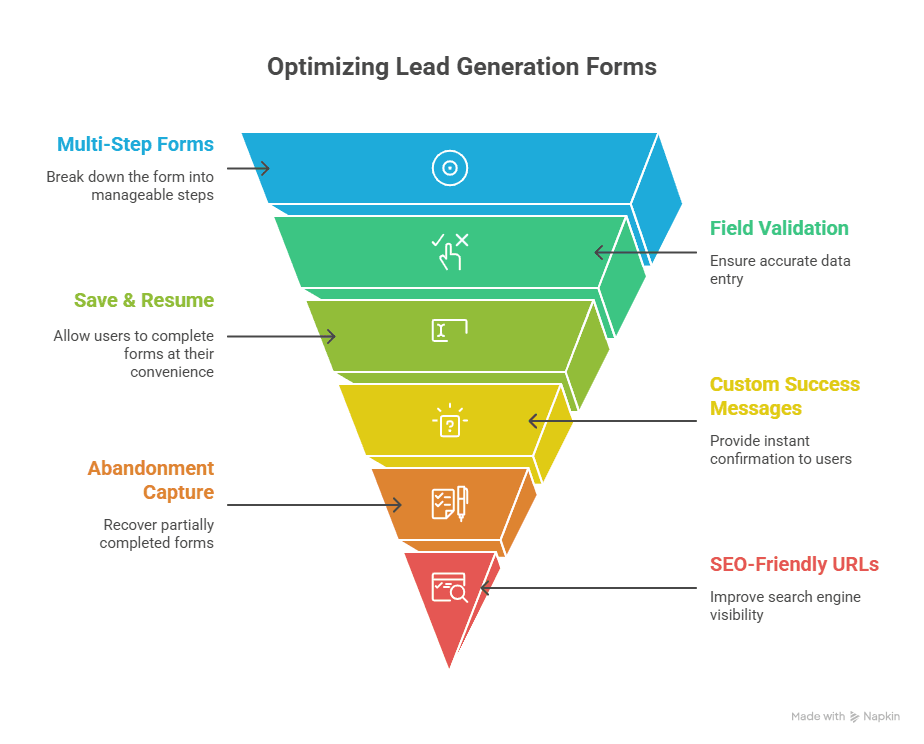

2. Use Smart, High-Converting Forms

Most insurance leads originate from website forms. So your form experience must be frictionless.

Best practices for 2026:

Multi-step forms: Increase completion rates

Field validation: Prevent incorrect emails/phone numbers

Save & resume: Helps with longer quote forms

Custom success messages: Confirm submissions instantly

Abandonment capture: Recover partially completed forms

Unique SEO-friendly URLs for each form: Improves indexation

Bonus

GrowthBeam’s built-in form system auto-scores leads based on intent signals, helping agents prioritize the hottest prospects first.

3. Add Local Trust Signals (Maps, Google Business, Local Listings)

Insurance is trust-driven.

Adding Google Maps, local listings, NAP (Name, Address, Phone) consistency, and updated reviews strengthens your local visibility and credibility. Customers want agents who feel “reachable” and “real.”

Must-do steps:

Add your office map on your website

Create and optimize your Google Business Profile

Add operating hours, services, images, and FAQs

Encourage happy clients to leave reviews

Local visibility = more inbound leads.

4. Build High-Impact Landing Pages for Every Policy Type

Generic “Contact Us” pages no longer work.

You need dedicated landing pages for high-intent searches like:

Best health insurance plan

Affordable auto insurance

Life insurance for young families

Commercial liability insurance

Term insurance for seniors

Corporate group policies

Each landing page should have:

Benefit-driven headline

Pain-point driven content

Social proof (reviews, case studies)

FAQ section

Clear CTA

Chatbot or instant quote tool

Chatbots are especially effective for capturing leads after hours.

5. Improve Your Lead Flow Using SEO (Search Engine Optimization)

If someone is searching for insurance online, SEO puts YOU in front of them.

High-impact SEO steps:

Identify relevant insurance keywords

Create long-form helpful content

Optimize title tags and meta descriptions

Improve website speed

Acquire authoritative backlinks

Update content every 90 days

SEO compounds over time and becomes your most cost-effective long-term growth channel.

6. Create a Strong Content Strategy (Blogs, Guides, Videos, Comparison Tools)

Content builds trust.

Insurance shoppers want clarity, not jargon.

High-performing content formats:

“How to choose the right health insurance plan”

“Term vs whole life insurance explained”

“Top mistakes people make when buying car insurance”

Claims guides

Premium calculators

Video explainers

Insurance comparison charts

Educational content positions your brand as the expert—and leads start approaching YOU.

7. Use Social Media the Right Way

Insurance can feel complex, so your social presence should make it simple, approachable, and relatable.

Platforms to focus on:

Instagram (awareness, visual storytelling)

Facebook (local engagement, community posts)

LinkedIn (high-value commercial leads)

YouTube (explainer videos)

Post ideas for 2026:

Fraud awareness

Claims process breakdowns

Insurance hacks for families

Policy comparison reels

Festive safety tips

Customer success stories

Good content = trust.

Trust = conversions.

8. Scale Lead Generation With Modern Email Marketing

Despite being old-school, email remains one of the strongest lead-generation channels.

Email types that work best:

Welcome sequences

Insurance explainer guides

Renewal reminders

Policy updates

Drip campaigns educating the customer

Seasonal offer campaigns

Exclusive webinars / consult offers

Incentives like free quotes, checklists, or premium calculators dramatically increase response.

GrowthBeam can automate entire email workflows for each policy type, turning cold prospects into warm conversations.

9. Use Reviews & Testimonials to Build Instant Credibility

Insurance shoppers want social proof.

Showcase real experiences from real people.

Where to collect & display reviews:

Google

Your website

Landing pages

WhatsApp screenshots

Video testimonials

Trustpilot

Why reviews matter:

Increase conversion rate

Enhance local SEO

Build immediate trust

Reduce sales objections

A strong review system can boost organic lead flow by 30–50%.

Why 2026 Insurance Agents Are Switching to GrowthBeam

Most insurers struggle because:

Website traffic is inconsistent

SEO takes months

Paid ads are expensive

Shared leads convert poorly

Manual follow-up drains time

Leads stop responding after 1–2 attempts

GrowthBeam solves all of it.

GrowthBeam gives insurance companies:

Exclusive, high-intent leads (not shared with competitors)

AI-personalized outreach across email + social

Automated follow-up sequences

Lead scoring to prioritize hot prospects

Real-time analytics

Scalable outbound campaigns without hiring SDRs

It’s the simplest, most effective insurance lead generation system for 2026.

Final Thoughts

The rise of digital awareness has opened countless opportunities for insurance agents. With the right strategy—website optimization, smart forms, SEO, strong content, social media, email, and reviews—you can generate consistent, predictable, and high-quality leads every month.

And with an AI-driven outbound platform like GrowthBeam, you can multiply your reach, automate your follow-up, and convert more prospects while spending less time chasing leads manually.