BLOG

8 Proven Techniques to Generate High-Quality Insurance Leads in 2026

Generating high-quality insurance leads in 2026 is about two things: value and precision. Consumers are savvier, advertising noise is louder, and data-driven experiences win trust. If you want sustainable growth, stop chasing clicks and start building predictable pipelines that convert.

Below are eight proven techniques that work across life, auto, health, and specialty insurance — with practical steps you can implement this week.

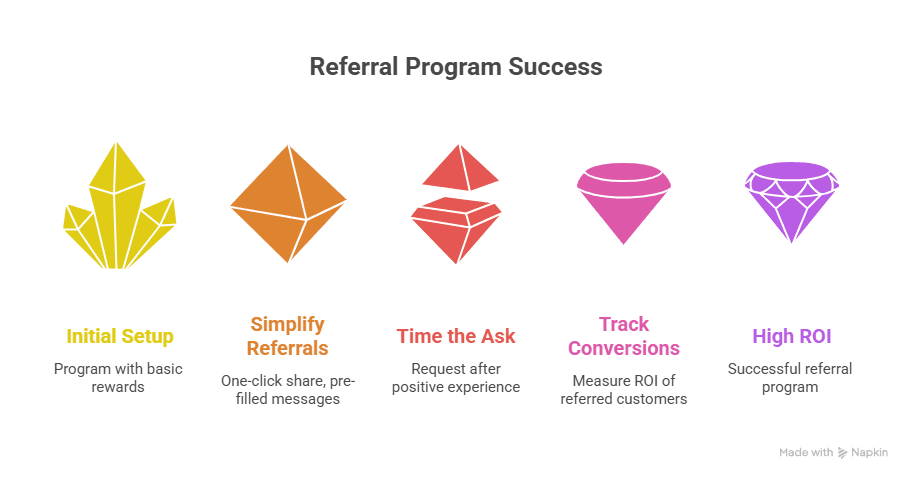

1 — Invest in Referral Marketing (lowest CAC, highest intent)

Referrals are the highest-quality leads you’ll get. People trust recommendations from friends, family, and even strangers more than ads.

How to run a referral program:

Offer simple, trackable rewards (discounts, gift cards, policy credit).

Make referrals frictionless: one-click share, pre-filled messages.

Ask right after a positive moment (claim resolved, policy renewal).

Track referred conversions separately to measure ROI.

Why it works: referred customers convert faster and have higher LTV.

2 — Launch a Partnership Program (scale through other audiences)

Partner with businesses that serve the same customers but don’t compete with you — mortgage brokers, auto dealers, HR firms, financial advisors, or affinity groups.

Partnership playbook:

Create co-branded offers and clear partner commissions.

Supply partners with pre-built landing pages and pitch decks.

Run joint webinars, email swaps, and referral contests.

Use partner-tracking UTM links or partner IDs to measure impact.

Tip: prioritize partners who already have trust with your target demographic.

3 — List on Price Comparison Sites (capture high-intent shoppers)

Price-comparison platforms capture buyers late in the funnel — people ready to purchase. Being visible here drives a steady stream of qualified leads.

Best practices:

Keep product info and pricing accurate and up-to-date.

Highlight unique benefits (fast claims, family discounts, bundled savings).

Test A/B creative and promo copy for conversion uplift.

Analyze performance and pause low-margin listings.

Comparison leads cost more per click — but convert at a higher rate. Treat them like premium inventory.

4 — Content Marketing (build trust and long-term inbound)

Content establishes authority and powers SEO. In insurance, trust equals conversions.

High-impact content formats:

Buyer guides (e.g., “How to Choose Auto Insurance After an Accident”)

Case studies and customer stories

Short explainer videos and infographics

Policy comparison pages and calculators

Webinars for niche verticals (gig workers, small business owners)

Distribution tip: promote content in targeted email segments and LinkedIn groups to drive qualified traffic.

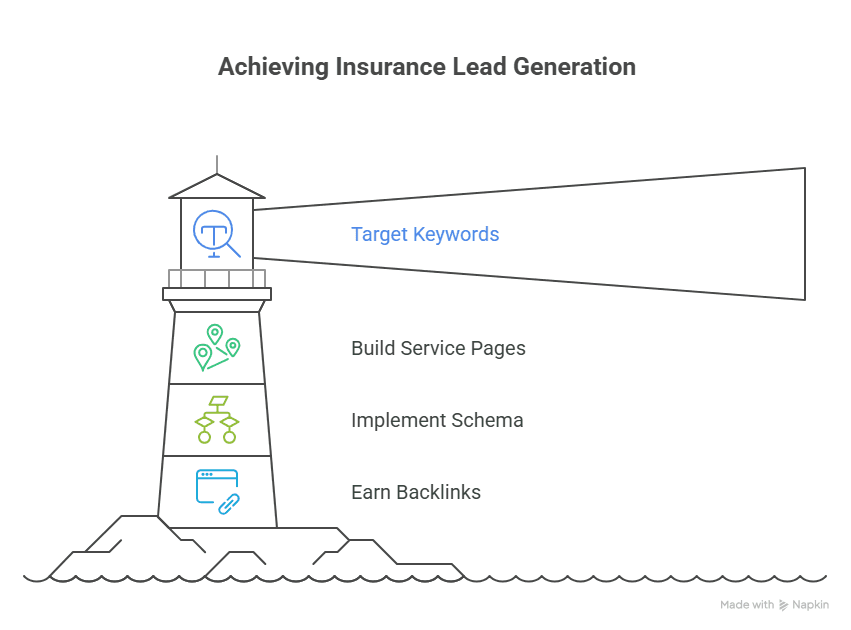

5 — SEO (organic, compounding visibility)

SEO is the best long-term channel for high-intent insurance searches.

Action checklist:

Target commercial intent keywords: “buy term life insurance”, “best small business liability insurance”.

Build service pages per product + location for local search.

Use schema for policies, FAQs, and reviews.

Earn backlinks via guest posts, partner pages, and PR.

SEO takes time — but once it ranks, leads come reliably without ongoing ad spend.

6 — Social Media Marketing (awareness + intent capture)

Social platforms are both discovery and remarketing channels.

How to use them effectively:

LinkedIn for commercial insurance & partnerships.

Facebook/Instagram for consumer lines and local promos.

Short-form video (Reels/TikTok/YouTube Shorts) to explain coverages and dispel myths.

Run lead-gen ad campaigns with clear offer (free quote, checklist, webinar).

Engage: respond to comments, run polls, and repurpose FAQs into posts.

7 — Email Marketing & Nurture (convert interest into policyholders)

Email is the backbone of conversion and retention.

Nurture sequence ideas:

Welcome flow with a strong lead magnet (quote checklist, policy guide).

Drip series: education → social proof → offer → scarcity.

Re-engagement campaigns for lapsed shoppers or expired quotes.

Cross-sell sequences for existing customers (home + auto bundle offers).

Segment, personalize, and A/B test subject lines and CTAs.

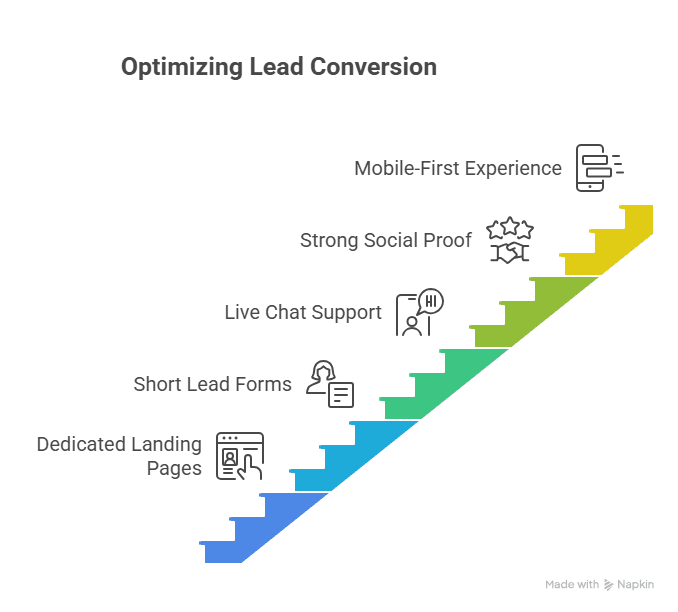

8 — Optimize Your Website for Conversion (capture more of the traffic you earn)

Your website must convert visitors into leads — fast and frictionless.

Conversion checklist:

Dedicated landing pages for each offer with a single CTA.

Short, progressive lead forms (start with email/phone, ask more later).

Live chat or chatbot to capture intent outside business hours.

Strong social proof: reviews, claims-handling stats, customer quotes.

Fast mobile-first experience and clear, trust-building microcopy.

Track micro-conversions (CTA clicks, phone taps, chat starts) to identify leaks.

Measure, Iterate, and Prioritize What Moves the Needle

Key KPIs for insurance lead gen:

Lead volume & lead quality score

Conversion rate (lead → policy)

Cost per acquisition (CPA) and customer acquisition cost (CAC)

Time-to-conversion and average deal size

Lifetime value (LTV) by channel

Run 1–2 experiments at a time, and scale winners. If a tactic doesn’t produce qualified leads in 30–60 days, reallocate spend.

How GrowthBeam Helps Insurance Teams Scale Lead Gen (without the noise)

Most insurance teams fail not because they lack ideas — but because they can’t execute consistently across channels. GrowthBeam solves that by:

Finding the right prospects with ICP-driven list building.

Prioritizing intent so you contact buyers who are actually researching policies.

Automating personalized outreach at scale (email, LinkedIn, SMS).

Connecting listings & partners to track true referral ROI.

Delivering verified leads and conversion analytics so you know what works.

If you want to pilot a program that mixes referrals, partnerships, price-listing optimization, and automated nurture — GrowthBeam can run the first 30 days and hand you a repeatable playbook.

👉 Try GrowthBeam for insurance lead generation — book a pilot and get your first qualified leads this month.

If you’d like this as:

WordPress-ready HTML

A one-page PDF checklist

5 short social captions and 3 email subject lines

Say which one and I’ll drop it in your preferred format.